- Community Home

- >

- HPE Community UK, Ireland, Middle East & Africa

- >

- HPE Blog, UK, Ireland, Middle East & Africa

- >

- Banking on HCI 2.0

Categories

Company

Local Language

Forums

Discussions

Forums

- Data Protection and Retention

- Entry Storage Systems

- Legacy

- Midrange and Enterprise Storage

- Storage Networking

- HPE Nimble Storage

Discussions

Discussions

Discussions

Forums

Discussions

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

- BladeSystem Infrastructure and Application Solutions

- Appliance Servers

- Alpha Servers

- BackOffice Products

- Internet Products

- HPE 9000 and HPE e3000 Servers

- Networking

- Netservers

- Secure OS Software for Linux

- Server Management (Insight Manager 7)

- Windows Server 2003

- Operating System - Tru64 Unix

- ProLiant Deployment and Provisioning

- Linux-Based Community / Regional

- Microsoft System Center Integration

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Community

Resources

Forums

Blogs

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Receive email notifications

- Printer Friendly Page

- Report Inappropriate Content

Banking on HCI 2.0

My colleague, Matt Shore wrote this short article on the move towards HCI 2.0 within banking which I thought those of you who follow me might also apprecaite.

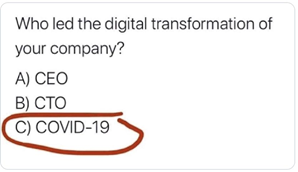

There’s a clever meme doing the rounds that sums up the business experiences of the past year—and it’s especially apt in the banking and finance sector:

Overdue digital transformations were already under way in the finance sector when the pandemic arrived and rapidly truncated timelines. Projects initially planned to roll out over years were implemented in mere weeks. The big insight from the pandemic? When stress-tested, humans can innovate remarkable solutions to intractable problems.

Similarly, this is how HCI was born: out of the need to solve business problems in a rapidly changing environment. In its simplest form, HCI allows you to scale by adding preconfigured building blocks. It also has the additional benefits of easy deployment, simplified management, automated configuration and one-click software upgrades. Additional nodes of both compute and storage can be added to the pool of storage and compute resources, as needed.

The big promise was that, by simplifying management and configuration, the manual burden on IT staff would be reduced and those valuable human resources who were fighting fires could instead be freed to innovate. HCI was the ‘silver bullet’ that allowed organisations to scale fast, spin up VMs on demand and provision resources as required.

HCI 1.0 had serious limitations

As organisations started to widely adopt HCI, it became apparent that HCI could become wasteful. These organisations noticed that they needed to add more physical resources (CPU, memory, and storage). But, due to architectural limitations of traditional HCI, all these components need to be added at the same time, usually resulting in underutilised assets.

Traditional HCI solutions were not always able to meet the low latency and high availability needs of mission-critical business applications. Traditional HCI was sold as a one platform for all workloads, but in short, HCI’s architecture is fundamentally flawed, because it requires trade-offs between simplicity and performance, which compromises its one-size-fits-all approach.

HCI is ideal for predictable, non-intensive workloads, but IT infrastructures in the financial industry have struggled to bear the burden of heavier workloads brought on by remote transactions, virtual working, and unpredictable growth of data.

For customer-facing financial institutions, any disruption can mean an unacceptable loss of service. As Tony Pannone, CIO of Highmark Federal Credit Union, in Rapid City, South Dakota, puts it: “Everybody expects access to their money instantly. And whether that delivery channel is through a mobile app, through a website, coming into a branch, or an ATM, you need your data connectivity. It's not a matter of waiting ten seconds, it’s a matter of, it’s got to be there.”

To future-proof their IT environments, financial pioneers are rapidly adopting intelligent disaggregated HCI, or dHCI, a new hyperconverged architecture that delivers agility without losing resiliency or performance. HPE HCI 2.0 is the solution enterprise needs to power all apps at scale without trade-offs between simplicity and performance which compromise its business value.

HCI 2.0 marries the best of hyperconverged infrastructure and converged architectures, allowing for independent scaling of compute and storage. For a financial sector desperate to lower costs and increase agility, HCI 2.0 means no bottlenecks in network traffic, and no lags in performance.

Financial sector banks on next generation HCI

Demand for digital banking services coupled with falling interest rates has pushed banks to re-evaluate their offerings. To stay competitive as the profitability of core banking services continues to fall, banks are shifting their focus to creating superior customer service experiences through online and mobile banking applications.

The increasing reliance by consumers on digital and contactless channels means banks need to ensure that digital platforms are equipped to handle increased workloads, that data remains secure and compliant with dynamic regulations, while infrastructure remains intelligent and agile enough to meet an uncertain future.

Central Pacific Bank, a commercial bank headquartered in Honolulu, Hawaii, was running out of storage space, and was experiencing infrastructure challenges that made it harder to maintain security and compliance. CPB turned to HPE and local partner Pacxa to implement a secure, compliant, and seamless solution for the bank’s remote employees across 35 branches.

Implementing HPE Nimble Storage dHCI enabled CPB to provide their remote workforce with the tools needed to continue working effectively. Importantly, the intelligent infrastructure helped give the bank a competitive edge when the shelter-in-place guidelines were enacted due to COVID-19.

HPE HCI 2.0—The next generation of HCI

With the help of HPE and Pacxa, the bank implemented 1000 virtual desktops, while simultaneously rolling out Microsoft Office 365 and Windows 10 Enterprise throughout the organisation. The consolidation of data and computing with HPE Nimble Storage dHCI led to an overall decrease in infrastructure spend, while the IT department now has centralised control and can more easily deploy technology updates and onboard new employees.

“We look for reliability, scalability, cost, performance, security and compliance when deciding on a new technology vendor,” said Adrienne Chee, Senior Vice President of Technology Operations at Central Pacific Bank. “We made a substantial investment in HPE because we believe in the technology and are positioning ourselves for long-term growth and adaptation.”

There are secondary benefits brought about by being able to rely on an intelligent infrastructure, with far-reaching consequences, as Tony Pannone, of Highmark Federal Credit Union puts it: “Our jaw is still on the floor, when we saw Nimble Storage dHCI—how fast we were able to set it up and save time. And that means we have more time at home with our family, with our kids, the important stuff. And dHCI just gives you that time back.”

- Back to Blog

- Newer Article

- Older Article

- Mohamad El Qasabi on: How HPE is accelerating digital transformation in ...

- MargaretN on: Welcome to the Middle East Region Community Blog

- Martin Visser on: Everything-as-a-Service: Is your organisation read...

- Kevin Barnard on: Planning for what is next – Overcoming current cha...

- Chris_Ibbitson on: Multi-cloud in Financial Services

- DJMutch on: Think global. Act circular. The circular economy a...

- BrianJenkinson on: NVMe alone is not enough, it’s time for Storage Cl...

-

Coffee Coaching

6 -

Technologies

292 -

What's Trending

62 -

What’s Trending

155 -

Working in Tech

147