- Community Home

- >

- Services

- >

- The Cloud Experience Everywhere

- >

- Big Data Analytics + IoT in Banking & Finance: 9 E...

Categories

Company

Local Language

Forums

Discussions

Forums

- Data Protection and Retention

- Entry Storage Systems

- Legacy

- Midrange and Enterprise Storage

- Storage Networking

- HPE Nimble Storage

Discussions

Discussions

Discussions

Forums

Discussions

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

- BladeSystem Infrastructure and Application Solutions

- Appliance Servers

- Alpha Servers

- BackOffice Products

- Internet Products

- HPE 9000 and HPE e3000 Servers

- Networking

- Netservers

- Secure OS Software for Linux

- Server Management (Insight Manager 7)

- Windows Server 2003

- Operating System - Tru64 Unix

- ProLiant Deployment and Provisioning

- Linux-Based Community / Regional

- Microsoft System Center Integration

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Discussion Boards

Community

Resources

Forums

Blogs

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Receive email notifications

- Printer Friendly Page

- Report Inappropriate Content

Big Data Analytics + IoT in Banking & Finance: 9 Examples (2018)

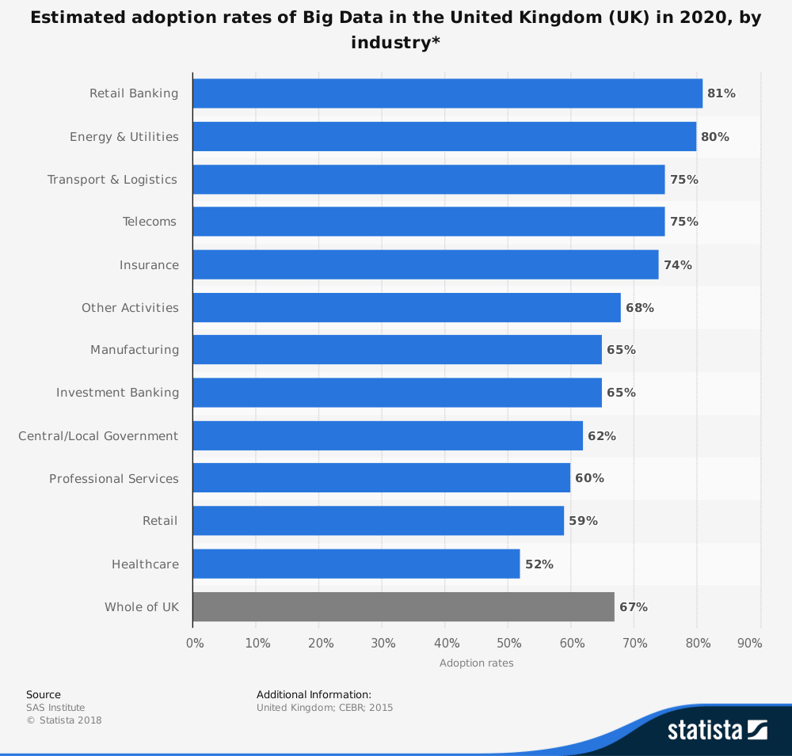

More than 40 percent of financial companies are experimenting with Big Data and IoT, according to a recent report. What’s more, it’s projected that retail banking organisations will lead the adoption of Big Data by 2020, by a staggering 80 percent [Source].

However, some businesses are still in the dark about the benefits IoT and Big Data analytics can bring.

To shed some light on the potential of these technologies, let’s take a look at some of the key emerging Big Data and IoT trends in finance to give you a taste of the 'art of the possible'.

Retail banking estimated to lead Big Data adoption by 81 percent.

Retail banking estimated to lead Big Data adoption by 81 percent.

IoT and Big Data analytics in Banking & Finance: 9 Real-Life Business Examples

1. 70 Percent of Organisations are Investing in Risk Modelling and Fraud Detection

Fraudulent crimes impact financial services on a daily basis.

If they’re not handled quickly or efficiently, they can cause serious reputational damage to individual businesses and firms. It’s no surprise, therefore, that almost 70 percent of businesses are interested in fraud detection AI and IoT functions.

Tracking certain pools of data (such as the geolocation of a customer’s assets) can help pinpoint the likelihood of a fraudulent event. For example, HSBC has collaborated with SAS Fraud Management to harness Big Data and IoT and detect fraudulent behaviour in ATM transactions.

As a result, the company is seeing a dramatic reduction in fraudulent activity.

Banks can also harness machine learning to create self-learning risk models. These help financial organisations better prepare for the detection of fraudulent transactions and other suspicious activity.

2. Smart Algorithmic Trading: One of the Biggest Profitable AI use cases

Instead of relying on human emotion or gut instinct for trade investments, organisations can use IoT models to learn from historic events and make smarter decisions based upon mathematics, finance models and data.

These algorithms also incorporate real-time data (such as stock exchange rates and social media trends) to keep companies up-to-date on current financial movements.

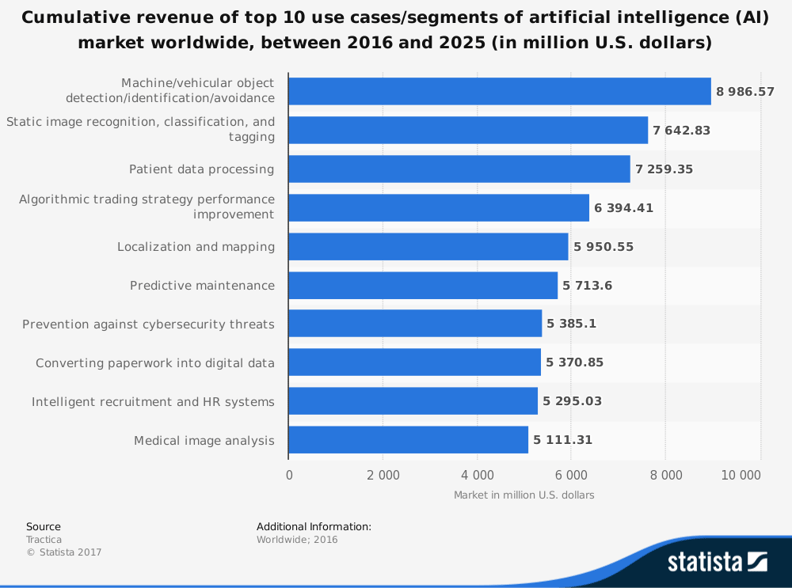

In the long run, this can help your company makes smarter investments and reduces the likelihood of lost revenue. In fact, smarter trading is within the top four most profitable use cases of AI in the world.

‘Algo trading’ like this is becoming increasingly popular and profitable across the globe, with businesses investing in IoT technology and machine learning over human methods.

Programs such as Quantopian, for instance, allow anyone to write investment algorithms.

3. Over half of Organisations see Value in Bettering Customer Outcomes

More than 50 percent of financial and banking markets rate ‘customer-centric outcomes’ as their biggest Big Data objective.

It’s no surprise; after all, your customers are your organisation’s lifeblood and ensuring their happiness is central to any business success.

The innovative use of Big Data and IoT in banking and finance allows organisations to analyse user behaviour, and discover how often customers visit merchants, transact money or enter select bank branches. Integrating this analysis into business models helps create customer-centric deals, personalised offers and messaging.

Much like Netflix and Spotify suggest similar film or music recommendations, based on users’ historic data, banks can provide personalised retail offers or discounts.

But this isn’t all.

Some banks are using IoT fintech as a force for good. Barclays, for instance, have invested in ‘beacon technology’, which alerts staff members when a person with a disability individual enters their branch. The technology also tells employees about their specific requirements, helping create a personalised and accessible experience for visitors.

4. Process Automation Market Size to Double by 2020

Some backend processes take weeks to plan, approve and execute manually. Loan underwriting, for example, can take up to 60 days from start to finish.

As well as eating up your employee’s time, manual processes such as these are often biased. Approving or disapproving loans is a difficult decision to make and employee judgement may differ.

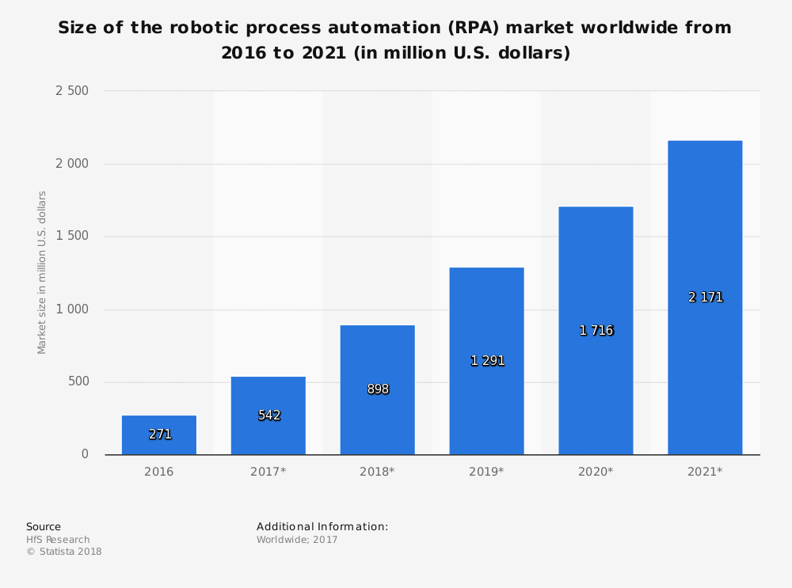

It’s no surprise, then, that many organisations worldwide are beginning to see the business benefits of robotic process automation. In fact, it’s predicted the market size will more than double by 2020.

Using the power of Big Data and predictive modelling, underwriting becomes a more accurate art. Many insurers and reinsurers, such as RGA, now offer automated underwriting processes, which organisations can use to create their own underwriting rules and decision trees.

This helps financial organisations save time and approve or deny loans objectively.

5. Internet-Connected Wearable Users to Increase

By 2022, there will be an average of 345 million people using wearable devices on a daily basis. However, these devices aren’t just for healthcare organisations and fitness tracking fanatics.

With developments in IoT in banking, organisations can create innovative wearable devices for customer and business convenience. As an example, imagine wearing your bank on your wrist and making quick payments with the flick of your hand, with devices such as FitPay.

Although these devices require a lot of thought, ingenuity and, of course, data, they are no longer elements of science fiction. And they don’t just have to be for your customers’ convenience either.

Certain IoT devices in banking, such as smart glasses, are used to help detect fake checks. By connecting the wearable to a computer, a bank teller can process the check’s credentials automatically.

After comparing routing numbers and bank account details with database records, the glasses send an automated alert to the employee, instructing them on whether to approve or deny the check.

6. Analyse Larger Pools of Compliance Information with Data Analytics

Banks today have a wide range of regulations they must adhere to. Unfortunately, keeping compliant is a difficult challenge if you don’t spot issues straightaway.

With the help of Big Data analytics, banks can examine a larger pool of compliance data, such as:

- Transaction data and the times of these transactions

- Customer data, personal information and social security details

- Census and demographic data

- Any bank-related complains or disputes

- Socioeconomic data

- Some public or market information

Analysing these datasets allows financial organisations to discover compliance anomalies and risks (such as incorrect transaction data) before they turn into wider business issues.

7. Improve Client Retention and Make Better Business Decisions

With access to large pools of vital historical data, banks and other financial organisations can form a complete, accurate overview of their cliental. This, in turn, can help them to make better customer relationship choices.

Ultimately, customer profiles, as well as trading and transaction information, give banks all the information they need to make more calculated trade deals and acquisitions. This takes the risk out of business critical decision-making.

8. Increase Employee Engagement

By using Big Data analytics in the banking industry, it’s not just trading and customer experiences that benefit. Firms can also increase their employee engagement.

By applying analytics across the board, your business can begin to better track and analyse the performance of your employees. As well as ensuring that everyone is working to the right standard, Big Data analytics allows you to understand how to improve employee productivity.

For example, by using biometric login systems, such as fingerprint analysis or facial recognition, you can clearly see who is and isn’t in the office. In the long run, this gives you a more accurate overview of employee leave and highlights trends in absenteeism.

9. Analyse and Streamline your Business Processes

So far, most of these IoT and Big Data examples have been big, bold and verging on futuristic.

However, it’s important to understand that you can also collect, analyse and harness data to help streamline existing business processes.

Industries such as manufacturing and retail are adopting IoT technology to help monitor specific machines, track their performance, measure output and predict downtime. Adopting this mindset in financial services can give you a bird’s eye view of all your processes and help you understand where bottlenecks are occurring.

Ultimately, this enables you to streamline applications and workflows and ensure that each part of your organisation is in harmony with the rest.

Embracing Big Data and IoT in Finance

More than 94 percent of businesses see a return on their IoT investments, increasing both productivity and customer satisfaction as a result.

Of course, if you want to satisfy your customers, improve risk modelling, or streamline and automate processes, then Big Data analytics needs to form the backbone of your solution.

To summarise, here are the 9 examples of IoT and Big Data analytics in banking that will become far more ubiquitous in the next few years:

9 Real-life Examples of IoT and Big Data Analytics in Banking & Financial Services

- Risk Modelling and Fraud Detection

- Smart Algorithmic Trading

- Bettering Customer Outcomes

- Process Automation

- Internet-Connected Wearables

- Tackling Wider Compliance Regulations

- Improving Client Retention

- Increasing Employee Engagement

- Analysing and Streamlining Business Processes

To make the most of these innovations, IoT investments require a lot of careful thought and due diligence. Without the right attitude, roadmap or expertise, your IoT project may never make it past the proof of concept stage. So, before you’re ready to turn insight into action, it’s important to assess the capabilities of your in-house team and decide whether partnering with a specialist can help you plug any gaps in your skillset.

To learn more about the ways we’re building new Big Data capabilities for the banking industry and financial sector, check out our IoT practice page.

- Back to Blog

- Newer Article

- Older Article

- Back to Blog

- Newer Article

- Older Article

- Deeko on: The right framework means less guesswork: Why the ...

- MelissaEstesEDU on: Propel your organization into the future with all ...

- Samanath North on: How does Extended Reality (XR) outperform traditio...

- Sarah_Lennox on: Streamline cybersecurity with a best practices fra...

- Jams_C_Servers on: Unlocking the power of edge computing with HPE Gre...

- Sarah_Lennox on: Don’t know how to tackle sustainable IT? Start wit...

- VishBizOps on: Transform your business with cloud migration made ...

- Secure Access IT on: Protect your workloads with a platform agnostic wo...

- LoraAladjem on: A force for good: generative AI is creating new op...

- DrewWestra on: Achieve your digital ambitions with HPE Services: ...